Industrial energy buyers have traditionally focused on end-of-year negotiations with utilities. But there is growing pressure from boards of directors for these buyers to be more flexible and reactive in their approach.

Should buyers comply, and if so, how often should they reassess their buying or hedging strategy?

The case for more flexibility

Market conditions

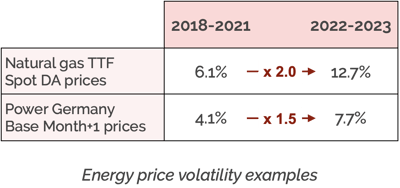

Since the beginning of 2022, energy price volatility has been extreme — averaging 150 to 200% of its 2018-2021 level, as illustrated by the following table:

We are not arguing that industrial buyers should become traders — staying glued to their computers all day and reacting to market changes by the tick.

But in such market conditions, fixing energy prices annually seems like playing roulette, while remaining open to unexpected adjustments appears more prudent.

Company priorities

Corporate decisions can also affect a company's energy buying or hedging strategy. Here are a few examples:

- Finance: Changes in risk management policy, the willingness to carry derivative instruments on the company's balance sheet, the accounting cycle...

- Sales: The ability to pass on energy price increases to customers...

- Energy mix: The conclusion of "green" power purchase agreements, the investment in in-house energy generation or energy storage capacity...

Free download

Direct material procurement - What to expect from machine learning

Such decisions are not necessarily known one year in advance, and may therefore require ad hoc adjustments to the company's energy buying or hedging strategy.

Reassessing vs. monitoring

Regular reassessments

In that context, we believe that industrial energy buyers should reassess their buying and hedging strategy at least twice a year.

These reviews should cover the following points:

- Proportion of spot, term-based vs futures transactions

- Mix of futures contracts

- Timing and level of coverage ratio targets

- Futures transaction frequency

- Risk management rule

And buyers should benchmark the buying and hedging strategies for both cost and risk:

- For cost, compare the average cost per MWh resulting from each strategy to the average market cost during the same period.

- For risk, compare the standard deviation of the prices paid under each strategy during the period to the standard deviation of the market price selected as your benchmark.

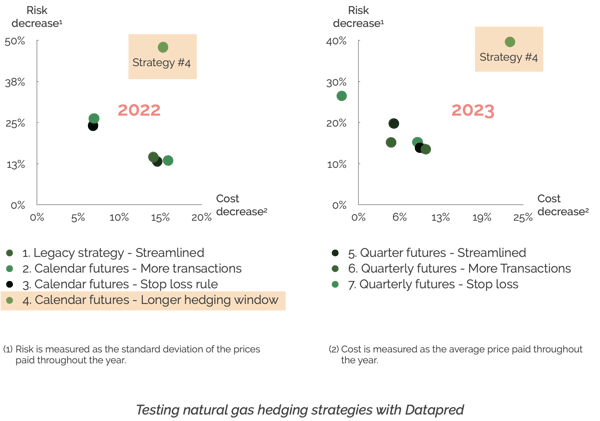

An energy-intensive company recently performed such a reassessment with Datapred, and the outcome was quite striking:

An alternative based on the same calendar futures, but involving more frequent transactions (to spread out the risk) and longer hedging windows (to optimize transaction timing) significantly outperformed the legacy strategy along both the cost and risk axes.

Continuous monitoring

Investing in professional energy-buying software and moving away from Excel can greatly assist with the regular reassessments we advocate.

It also allows buyers to continuously monitor their chosen strategy and alternatives, determining when to switch between them. Imagine the dots on the chart above, moving as market conditions change and company priorities evolve.

This approach provides a robust methodological framework while still allowing for flexibility and reactiveness within that framework. It truly is the best of both worlds.

***

Check out this page for more resources on energy procurement, or contact us for a demo of our integrated online software for energy buyers.