Optimize your energy and raw materials buying / hedging strategy

Quickly implement new buying and hedging strategies.

Are you struggling to transform market analyses and company guidelines into actual transactions ?

Energy and commodities buyers are under increasing pressure to justify their buying / hedging strategy, and to find price and price risk optimization opportunities.

- You are unsure about your existing buying/hedging strategy.

- Company directors are demanding quantitative backup.

- You need to adapt spot and futures transaction patterns to market dynamics.

- You are looking for reliable buying/hedging performance KPIs.

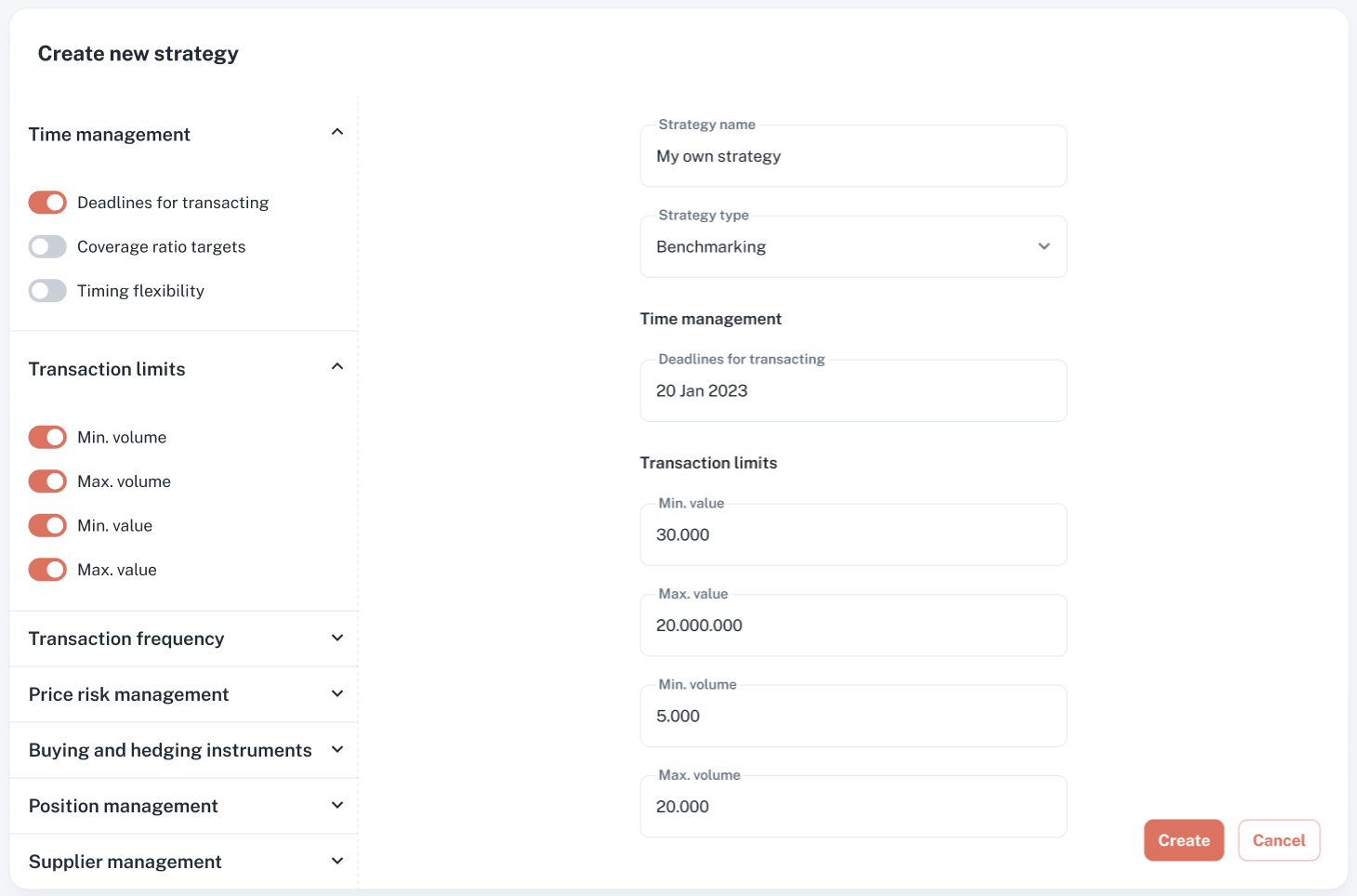

Quickly create the strategies you want to test

What is the right proportion of spot and futures transactions? Should you continue to favor calendar futures, or add quarterly futures to the mix ? How would a stop loss rule affect your risk / return profile ?

With Datapred, you can create in a few clicks the buying / hedging strategies you want to test — from scratch, or using one of the templates we provide.

It takes minutes, instead of the days you would need with Excel.

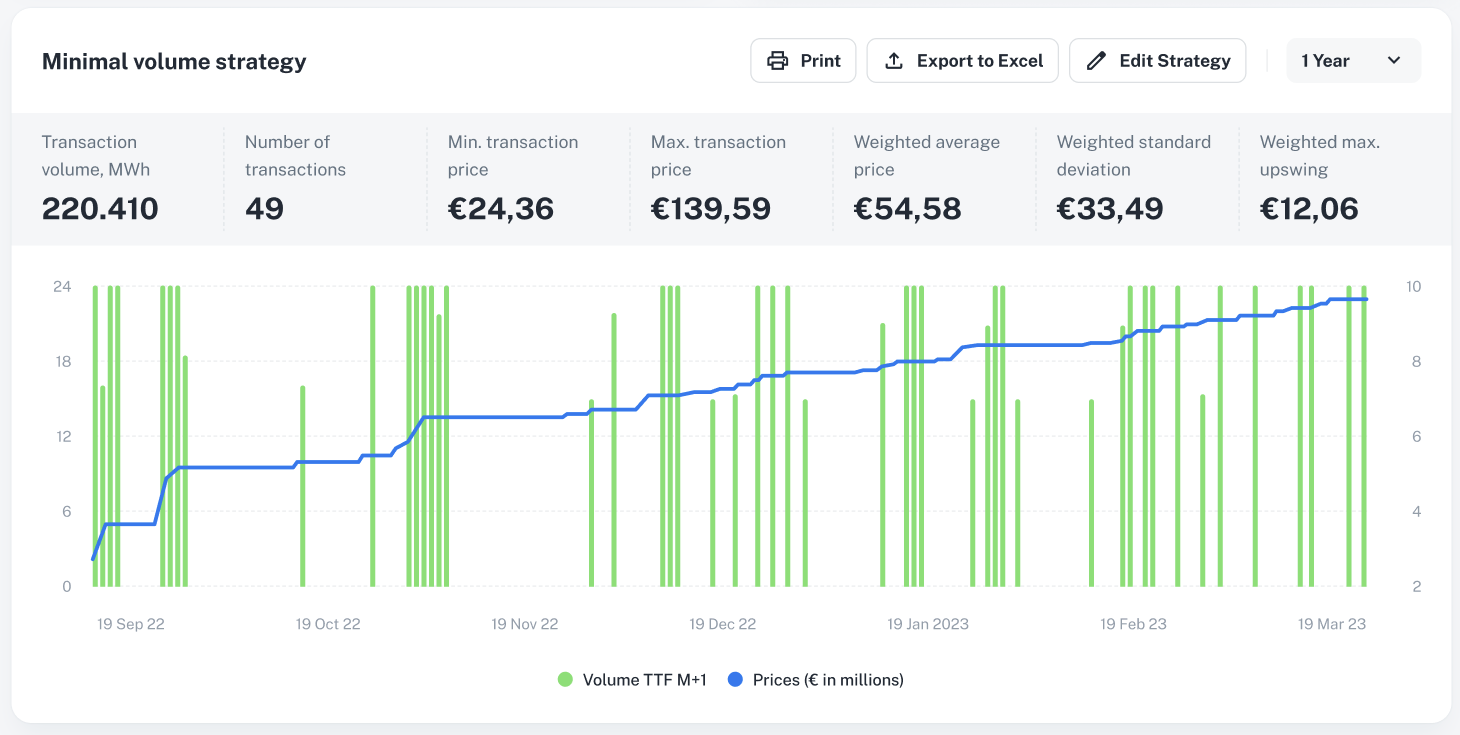

Continuously benchmark your strategies

Once you have created the buying / hedging strategies you want to test, Datapred helps you compare them by simulating the transactions that would have resulted from them in multiple conditions : during the past three years, during periods of high price volatility, of low price levels...

Always calculating the average transaction volume, transaction frequency, price and price risk resulting from your strategies.

And letting you select the best strategy with confidence.

Optimize strategy execution

You can link the buying or hedging strategies you have defined in Datapred's Decisions module to the consumption profile and the transactions in Datapred's Reporting module.

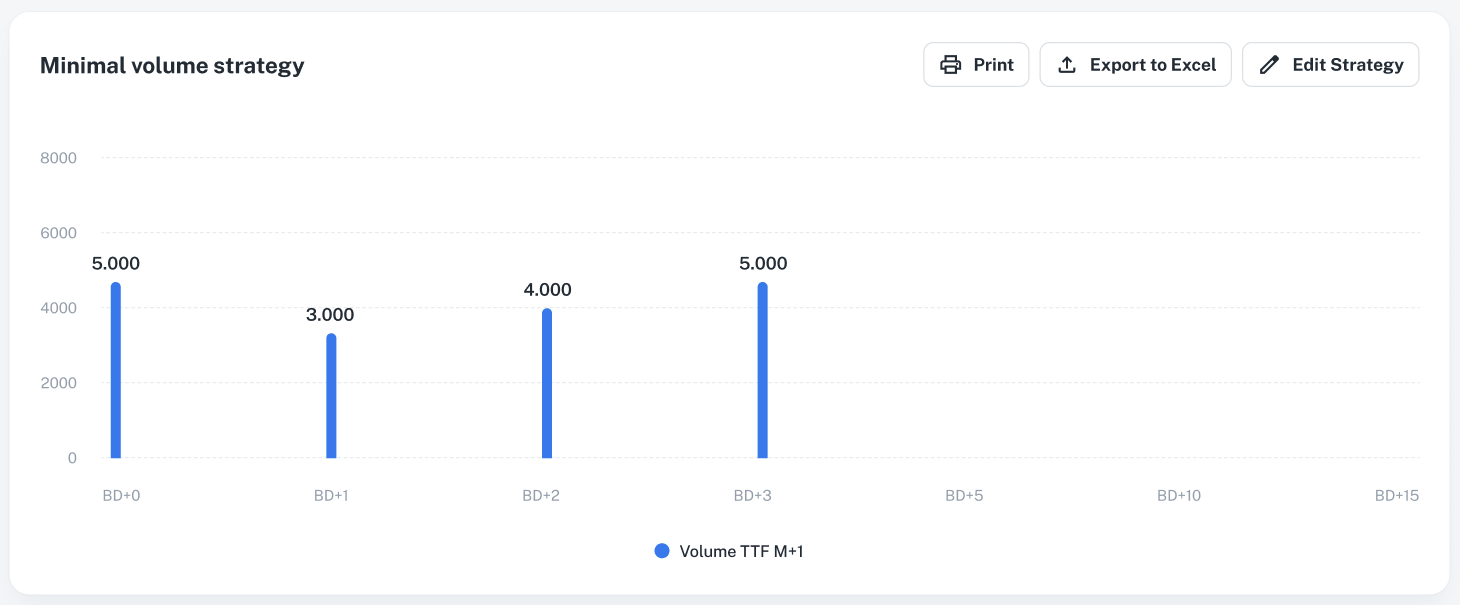

Datapred can then generate continuously-updated transaction suggestions — providing visibility on what you should do during the next few weeks given where you are in your energy procurement cycle, current and future market conditions, and your buying or hedging guidelines.