Energy and raw material prices had been all over the place since March 2020. And now this... Buyers are truly facing unprecedented conditions.

Quantitative analysis can help a lot, but more than ever it is critical to understand that "beating the market" is not the point.

The real point of "accuracy"

The efficient market hypothesis may have been challenged in countless ways since it was first formulated in the 1950s (!), it certainly lives strong with modern energy and raw material buyers.

Lots of them react to the perspective of using quantitative analysis with comments like: "You can't beat the market!", or "If you can anticipate prices, why are you not billionaires already?"

From that mindset comes an excessive focus on predictive performance ("accuracy") as an end in itself, whereas as an industrial buyer, you should think of accuracy as the IQ of quantitative market intelligence.

Free download

Direct material procurement - What to expect from machine learning

What matters then, is how you are going to use that IQ to navigate erratic energy and raw material markets.

Consistent reactivity

Consistent reactivity is the first major advantage of solid quantitative analysis for energy and raw material buyers.

Reactivity

Traditionally, industrial buyers have favored stable price management mechanisms, limiting their monitoring costs:

- Term-based supplier agreements with monthly price adjustments.

- Limited spot transactions and stable spot vs. term-based balance.

- Basic hedging policies - small number of contracts, rigid decision windows...

But in highly volatile markets, the costs of this approach outweigh its benefits. Too many missed opportunities, hidden risks, flawed decisions...

Quantitative analysis brings the real-time insights and solid backup you need to be more reactive. That doesn't mean turning into a trader - it's about calmly and opportunistically adjusting to market dynamics:

- Instead of renewing the same price adjustment formula year after year, reviewing and potentially amending it every quarter.

- Marking a larger proportion of total spend for potential spot transactions, and continuously updating that proportion.

- Instead of always using the same futures contracts for hedging, dynamically adjusting with the mix of futures contracts ("cascading").

- Instead of processing purchase orders immediately, potentially waiting a few days for better market conditions...

It's really about buyers following in the footsteps of their colleagues on the production line, away from large batches of standard products, towards manufacturing on demand.

Consistency

But of course reactivity shouldn't result in anarchy. A good quantitative framework will buttress the two kinds of consistency that matter to energy and raw material buyers.

- Time consistency. More reactivity means more decisions. It is a winning game when played consistently over time: you want to optimize each transaction individually, but also as part of an ever-expanding sequence. Continually mixing descriptive and predictive analyses will help you do that.

- Industrial consistency. Quantitative analysis can also ensure that increased market responsiveness doesn't come at the cost of reduced industrial efficiency. For example, what is the point of using more secondary materials, if the corresponding cost reduction is offset by higher energy requirements?

Scenario planning

Playing out scenarios, exploring boundaries, stress-testing... are time-honored ways to deal with uncertainty. Scenario planning is a special kind of quantitative analysis that provides unique market and operational insights.

Market scenarios

A market model is like a jelly shape: you can squeeze it in selected spots and see where the deformation reverberates.

For example, Datapred's Markets module includes two types of scenario planning:

For example, Datapred's Markets module includes two types of scenario planning:

- Price driver impact. Once you have quantified the price drivers for the energy or raw material you are buying, you can answer questions like "If energy prices rise 5% today, what is the likely impact on next month EPS prices?"

- Historical replay. With a robust quantitative market model, you can also "replay" past situations and assess their impact on current prices. For example: if the first lockdown happened again today, what would be the impact on German power prices?

Operational scenarios

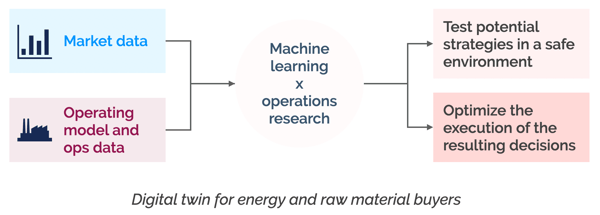

A proper digital twin for energy and raw material buyers will address not only the market-related aspects of the decision process, but also the relevant operational challenges:

That extends your scenario planning possibilities to internal decision factors and trade-offs. For example:

- With 10% more inventory capacity and an average order frequency of 30 instead of 60 days, would I have spent less on steel scrap these past 12 months?

- How much could I save if I added monthly futures to my usual mix of calendar futures?

- If I increased the proportion of palm oil in my vegetable oil mix, would the overall cost reduction compensate for the degraded quality and sustainability indices of my product?

***

Don't hesitate to contact us for a discussion of quantitative analysis in your context. You can also check out this page for links to interesting resources on digital procurement.