Many traders of European emission allowances (EUAs) monitor the spread between coal and natural gas prices.

Their intuition is that when coal becomes relatively cheaper than gas, the European economy burns more coal, which increases carbon emissions and boosts demand for EUAs (and reciprocally).

Using the analytical capabilities of our digital twin for raw material and energy buyers, we confirm that relationship - but maybe not to the extent that we expected.

The spread

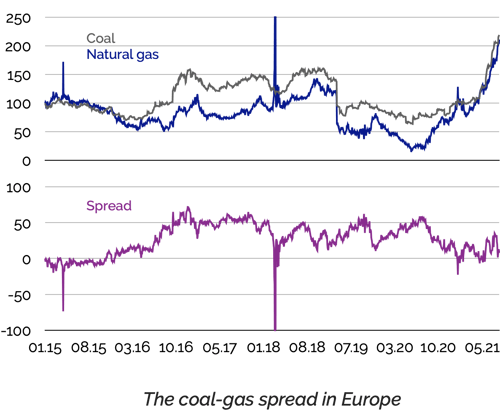

For coal and natural gas prices, we are using the M1 coal contract on the ICE and the M1 TTF contract on EEX (converting the USD ICE prices into EUR, and tons to MWh).

The following charts show how these prices (rebased to 100 on 1 Jan. 2015) and the corresponding spread have evolved recently.

Interestingly, the coal-gas spread has narrowed down notably since the beginning of the current inflationary period for energy prices.

Free download

Direct material procurement - What to expect from machine learning

The impact

General impact - Meaningful, not decisive

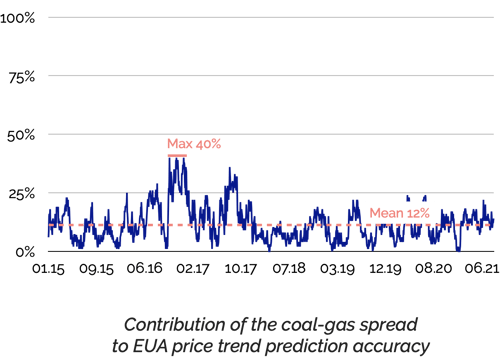

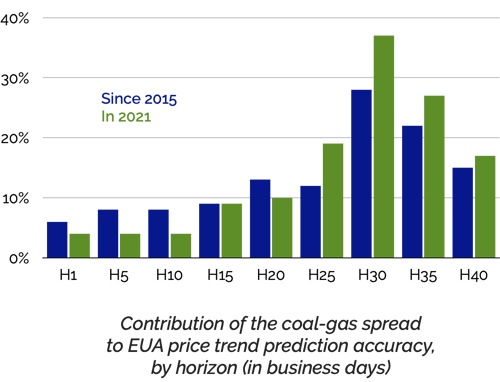

We are measuring how the coal-gas spread helps us anticipate EUA price trends, 1 business day to 40 business days (i.e. 8 weeks) ahead.

Since 2015, this "predictive contribution" has averaged 12%, as illustrated below.

The contribution has exceeded 25% a dozen times only during that period. Overall it's been quite stable, especially for the past three years - with no clear impact of the size of the spread.

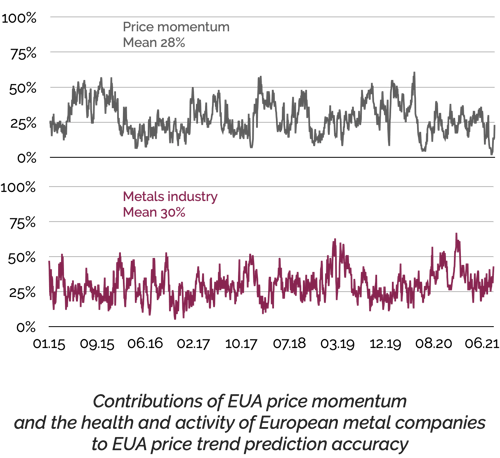

12% is not negligible, but it is roughly three times less than the contribution of price momentum (i.e. market buzz, short-term market movements) and the health and activity of the European metal industry (approximated by the stock prices of large European metals companies), as illustrated below.

So the conclusion is that, while the coal-gas spread does influence short- to mid-term EUA price trends, it is not the primary EUA price driver.

Short-term vs. mid-term

The measurable impact of the coal-gas spread on EUA price trends varies a lot with the duration of the trend. It is small for short-term trends, and larger for 4 to 8 week trends, with a peak for 6 week trends, as illustrated below.

As you would expect, the current speculation on the EUA market has reduced the usefulness of the coal-gas spread for understanding short-term EUA price trends (green bars much shorter than blue bars for H1 to H10 above).

But on the other hand, for anticipating 5 to 8 weak EUA price trends, the coal-gas spread has been significantly more useful in 2021 than since 2015 - even though the spread has actually narrowed. A consequence of the energy crisis?

In total: the intuitive relationship between the coal-gas spread and EUA price movements is real, and EUA market participants should definitely monitor the spread. But it is a dynamic relationship, and monitoring techniques should take that into account.

***

Don't hesitate to contact us to discuss how buyers of coal, natural gas, power or emission allowances are currently using Datapred.

You can also find interesting resources on energy procurement on this page.