Our solution for energy and raw material buyers can identify and quantify the drivers of energy and raw material prices. Following a client suggestion, we have recently tested whether Chinese economic activity had a measurable impact on European gas prices - the rationale being that at 10% of worldwide gas consumption, China has enough market power to move international gas prices.

Our test is conclusive - such an an impact is indeed visible, as discussed below.

Proxy and targets

We want to provide daily price driver analyses, but Chinese macroeconomic data is published monthly.

Faced with that difficulty, we are using our usual workaround of approximating a country's GDP with its main stock market index.

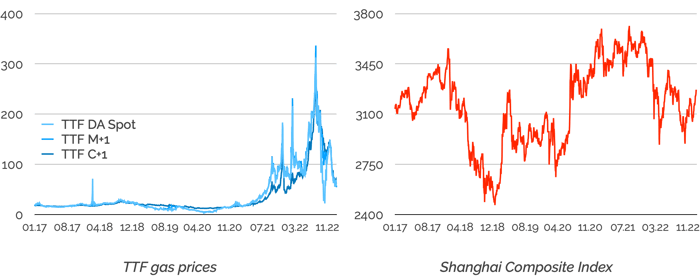

So the Shanghai Composite Index ("SSEC") is our proxy for Chinese economic activity.

For modeling targets (the gas prices potentially affected by China), we select three prices on the TTF hub: the day-ahead spot ("TTF DA Spot"), the first monthly future ("TTF M+1"), and the first calendar future ("TTF C+1").

Let's take a look at the data since 2017:

It is hard visualize the potential relationship between the SSEC and TTF gas prices based on these curves. We need some data engineering.

Free download

Direct material procurement - What to expect from machine learning

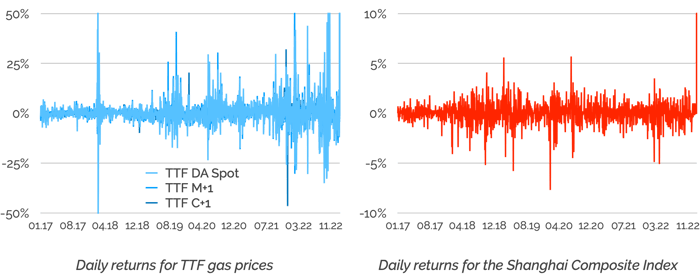

Specifically, we must remember that we care about trends: do trends in the SSCE help us understand trends in TTF prices?

It is thus more interesting, from a modeling perspective, to look for a relationship between SSEC variations and TTF gas price variations.

For example, between daily SSEC and TTF gas price returns:

That data transformation done, we can get Datapred's modeling engine to work.

Findings

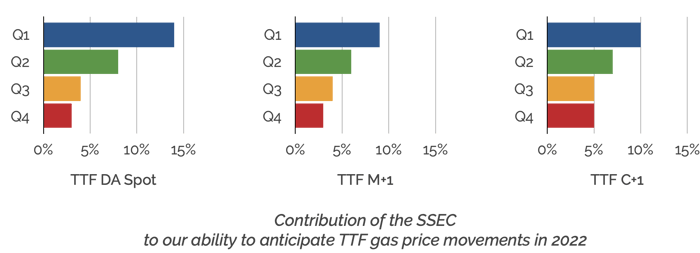

The general conclusion is that including the SSEC in our contextual data for TTF prices improves our understanding of TTF price movements.

Specifically, the SSEC contributes 6% on average to our ability to anticipate 1- to 45-day price movements for our 3 modeling targets in 2022, with a maximum of 14% for TTF DA Spot price movements during Q1 2022:

The main price drivers for TTF gas in 2022 are temperatures (20%), and the prices of other energy sources like coal and oil (14%).

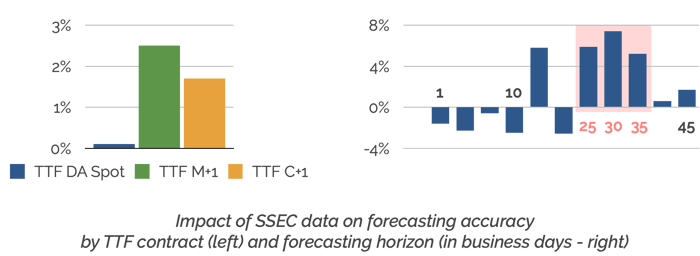

We can isolate the impact of SSEC data on specific TTF contracts and forecasting horizons:

It seems the SSEC is not so useful for spot gas prices and short-term gas price movements. Its explanatory power is greater for monthly and calendar futures, and for one- to two-month forecasting horizons.

Next steps

In total, we are happy with the experiment and grateful for our client's suggestion. We are now going to:

- Add SSEC data to the modeling of other European gas prices.

- Use SSEC data for market simulations.

- Deploy that in production, in the Datapred web application.

Stay tuned 🙂

***

For more resources on energy procurement, you can check out this page. Also feel free to contact us for a demo of Datapred's integrated online software for energy buyers: