For obvious reasons, raw material price volatility has increased in 2020 - and we have been monitoring that closely.

Datapred uses both price history and contextual data for raw material market analysis and price prediction, and as this year draws to a close, we would like to share five findings about the power of contextual data for understanding raw material prices.

1. Contextual data is powerful

To analyze the price of a given raw material, we routinely integrate over 50 contextual data streams, across quite diverse categories: commodity prices and indices, regional stock market indices, the stock prices of major raw material producers and consumers, energy prices, weather information, pollution levels...

The exact data streams and categories will change from one raw material to another, but we always find that contextual data modeling is more useful than statistical price analysis to understand raw material price movements.

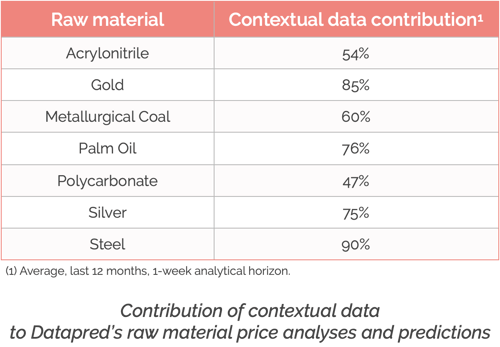

We can see that in the table below, for raw materials we have recently worked on:

This of course is good news for Datapred, since it means that machine learning is a big plus for raw material buyers. More generally, leveraging the power of contextual data is one of the defining aspects of digital procurement.

2. Contextual data contribution is fluid

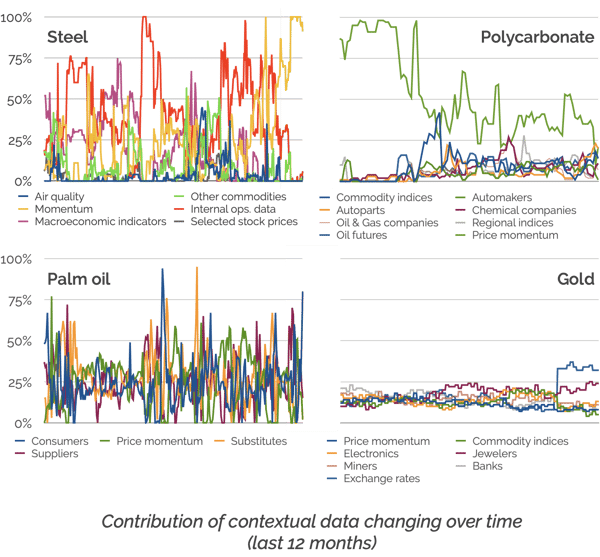

However (or moreover), the contribution of contextual data is not stable, but changes all the time. Here are a few examples (each line represents the contribution over time of one data category to model accuracy):

This has two notable consequences.

- From a business perspective, your price and margin simulations based on market drivers will be misleading, if you don't update market driver weights continuously.

- From a modeling perspective, you can't freeze market driver weights once and for all. Given how unstable they are, even periodical reviews would not work. Sequential updates are key.

3. Don't ignore internal data

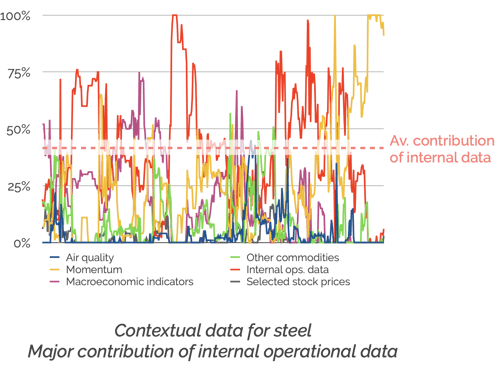

One finding that surprised us at the beginning, but that we have since confirmed across projects and raw materials, is that internal contextual data (your historical sales, inventory levels, production levels...) will often contribute significantly (10-20%) to understanding the price movements of the raw material you are buying.

Here is the (somewhat extreme) example of a large buyer of steel:

Our tentative interpretation is that we usually work with players that are so large in their respective markets, that their operations reflect industry-wide trends.

Anyway: that internal data is easy to access - it would be a pity not to take advantage.

4. Analytical horizons matter

We have seen above that contextual data contribution changes all the time. Similarly, contextual data contribution will always vary across analytical horizons.

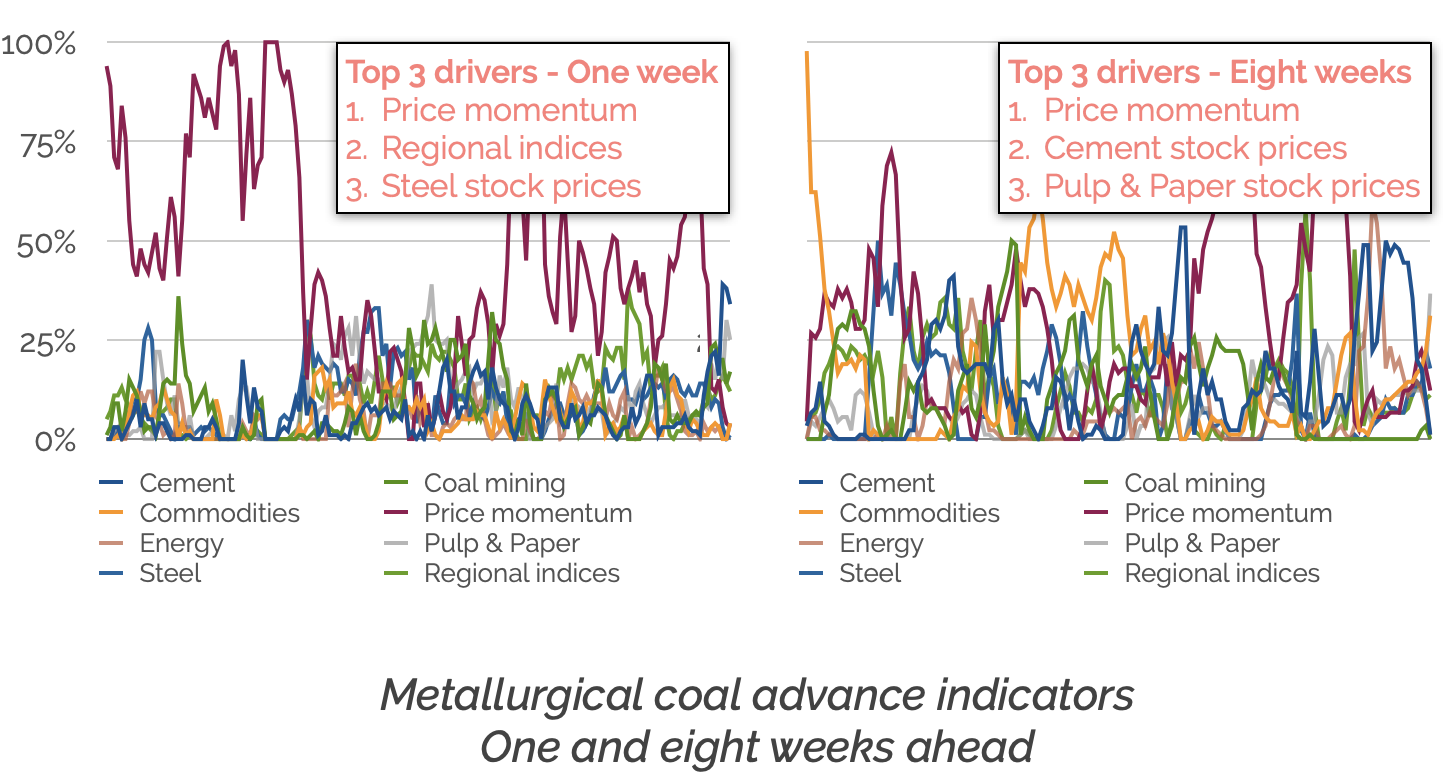

For example, when analysing the price of metallurgical coal, we can see below that contextual data contributions change quite a lot from a one-week to a eight-week analytical window:

It is intuitive that different factors should drive short- and long-term market trends.

It is also important, since it means that to understand raw material price dynamics, you need not one, but multiple price models running continuously - as many models as your decision horizons.

5. Market unrest increases target contribution

2020 is so different, it should be no surprise that one of our key findings emerged specifically this year.

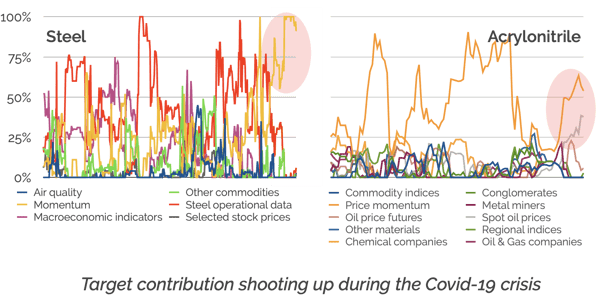

Since the pandemic began, we have repeatedly seen the contribution of historical target prices to our raw material price models shoot up. Here are two examples:

It is as if machine learning was telling us: "you know what, I don't understand context anymore, let's just focus on price momentum".

So more volatily, brutal market shifts, unheard-of situations... don't necessarily kill data analysis. But raw material buyers need an analytical framework that is versatile enough quickly to adapt to new circumstances.