Datapred's machine learning software for direct material procurement helps companies save 3-5% off their commodity, energy and raw material costs year over year, through a unique combination of price predictions and constraint optimization.

Occasionally, a skeptical Chief Procurement Officer will object that "it's not possible to beat the market".

That is reference to the famous efficient market hypothesis ("EMH"). It is important to understand why it is beside the point.

Quick summary of the EMH

The EMH is one of the most celebrated theories of financial economics - winning Nobel Prizes for its inventor (E. Fama) and many of his continuators (H. Markowitz, M. Miller, R. Merton, M. Scholes...) and critics (D. Kahneman, J. Tirole...).

The EMH states that on open markets (especially on modern financial markets), asset prices incorporate all available information on these assets. Price predictions are thus impossible - prices at any given time are their own best predictions, since they incorporate all the information that would feed alternative predictions. Asset prices are random walks and offer no arbitrage opportunities.

The EMH rests on two main assumptions:

- Market frictions (such as transaction costs or delays) are negligible.

- Market participant are rational (their brains work in the same logical way, and they react similarly to the same information).

Why the EMH is beside the point for direct material procurement

The EMH may or may not be verified

The EMH is very powerful. Modern finance wouldn't exist without it - it is very difficult to price an asset mathematically without referring to it.

But it is also hard to verify empirically, and a huge literature has emerged over the years challenging its two main assumptions:

- Markets are not frictionless. There are all sorts of market imperfections that could create arbitrage opportunities.

- Rationality, as defined by classical economics, is almost not human. That is why behavioral economics, which explores the limitations of that kind of rationality, has been so successful - including on the trading floor.

In a nutshell: it may or may not be possible to "beat the market". The question is not settled, academically and empirically.

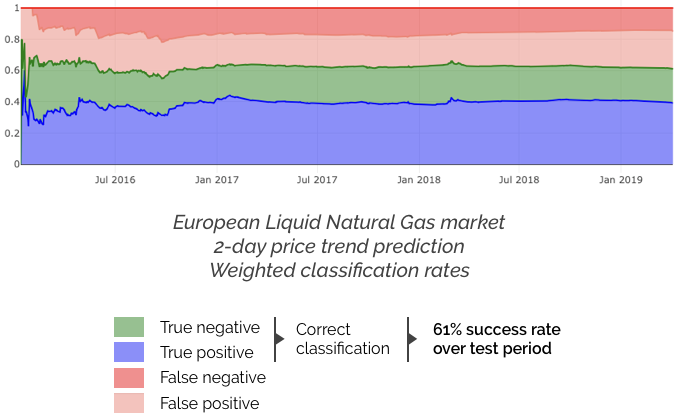

Some traders seem to be doing quite well for themselves. And more modestly, the price prediction part of Datapred's machine learning software for direct material procurement works usually well, even for openly traded raw materials or energies, as the following graph (from one of our recent projects) illustrates:

Most direct materials are not traded on open markets

The EMH only applies to prices on open markets. But most raw materials and commodities are not traded on such markets: they are traded over the counter, directly between individual buyers and sellers.

They often have an indicative public price (compiled by a trade organization or a professional information specialist) but it is not a proper market price. "Beating the market" makes no sense in these conditions.

To be fair, it is true that outstanding predictions are easier to achieve on non-market prices (public or private). We have reached price trend classification success rates as high as 80% on some of our projects - as opposed to the 55-60% we generally achieve with proper market prices.

"The market" is not the right benchmark

« You don’t have to outrun the bear, just the guy next to you ».

In other words, as a Chief Procurement Officer, is "beating the market" the right benchmark? You are not competing with professional traders, but trying to improve on your current direct material procurement strategy.

That strategy is probably low-speed, not data driven, and hard to audit - based on qualitative market research, in-house expert opinions and a few Excel files. Regardless of what "the market" is doing, machine learning will help you:

- Make sense of the vast amounts of data your existing process is ignoring.

- Accelerate your reaction time.

- Rigorously learn from your past procurement performance.

- Quantify your risk and identify individual risk factors.

Your real competition is not "the market" - it is the status quo.

It's about predictions and constraint optimization

Finally and critically, you are not buying in a vacuum. Your procurement strategy is constrained in all sorts of idiosyncratic ways: inventory capacity, production schedules, compliance rules, logistics costs and delays...

Pure price predictions would only take you so far. You would still have to figure out how best to transcribe them into actual purchase orders.

In other words, deciding when and how much to buy requires the dynamic combination of price predictions and constraint optimization.

"The market" becomes even less relevant a benchmark when you do that, since your output is a procurement program that is optimal in your specific context, but that would be useless to anyone else.

***

Dont hesitate to contact us to discuss the market analysis capabilities of Datapred. You can also check our page on digital procurement for more examples of machine learning applications along the source to pay process.