There was a time when energy buyers often reacted to the description of Datapred's buying and hedging optimization capabilities with an offended comment: "we are not speculators!"

We hear less of that nowadays — the energy market conditions of the past two years have shown everyone that speculation or not, creativity and reactivity were key for energy market participants.

However, clarifying the difference between speculation and optimization remains valuable.

Definitions

Speculation

Speculation is described as "the act of buying and selling based on anticipated future price fluctuations" — regardless of business fundamentals.

Speculators typically aim for quick profits but face substantial risks of potential losses, as their strategy heavily relies on timing and market volatility.

The classic example of speculation is the tulip mania of 1634-1637 in The Netherlands, when some futures contracts for tulip bulbs were changing hands five times before maturity.

For an energy buyer, engaging in speculation could involve trading power or natural gas futures to capitalize on energy price fluctuations, without considering the company's coverage needs.

Optimization

Optimization is defined as "achieving the best possible outcome within given constraints".

A classic optimization challenge could be figuring out how to pack multiple suitcases into the limited space of a car trunk. In this scenario:

- The ultimate goal would be to maximize the use of space by fitting each suitcase snugly.

- The constraints to consider would include the size and number of suitcases, as well as the dimensions of the trunk.

For managers, it entails making informed decisions that balance risk and return in a way that achieves the best results for the company.

Degrees of freedom

In many ways, speculation and optimization represent different degrees of freedom for financial managers in general and energy buyers in particular — each offering a distinct spectrum of choice and flexibility in decision-making:

- Speculation provides a high degree of freedom, allowing managers to make bold moves based on market predictions, intuition, or trends.

- Optimization operates within more defined boundaries. It involves using data analysis to identify the best course of action within the constraints of risk tolerance, regulatory requirements, and organizational goals.

We believe the growing flexibility of energy markets has created interesting "optimization pockets" for energy buyers, which they can leverage without turning into Gordon Gekko. Here are recent examples from Datapred clients:

- Depending on market conditions, hedging the company's exposure to propane prices 18 or 24 months in advance.

- Varying the company's monthly coverage ratio target for electricity between 75 and 90%.

- Increasing natural gas coverage by 5% increments upon reaching specific price thresholds.

These opportunities are contained — they exist within the "decision enveloppe" defined by management, which often includes simple but effective risk management rules. And they don't even require factoring in potential market trends, as discussed in our recent datasheet about energy hedging optimization.

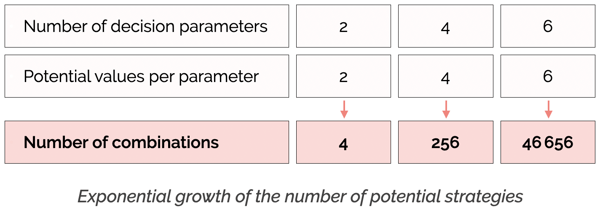

That's because optimization problems become complex so quickly that simply finding the best combination of "static" decision parameters yield positive results, as illustrated by this table:

Why should energy buyers be prevented from doing their best, like everybody else in the organization?

The evolution of energy procurement

Ultimately, instead of fearing what may appear as risky speculation but is actually sound optimization, it is wiser to acknowledge the positive evolution of the role of energy buyer.

Energy procurement used to be about negotiating rigid, multi-annual agreements with monopolistic utilities.

It is now a dynamic and proactive job, where knowledgeable managers continuously adjust for the benefit of their company, based on energy market conditions and the business rules and objectives they have been assigned.

Never pushing the enveloppe, but optimizing within the enveloppe they received.

***

With Datapred, energy buyers can explore buying and hedging opportunities in a few clicks. Don't hesitate to click the link below and schedule a demo with one of our experts!

You can also visit this page for additional resources on energy procurement.