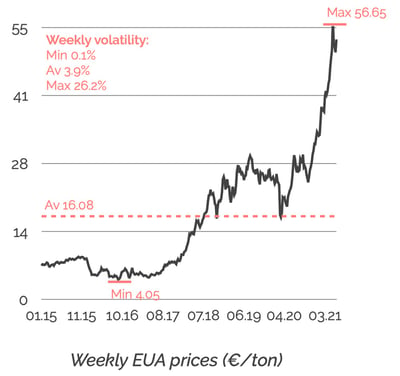

CO2 prices on the EU Emission Trading System (ETS) have recently skyrocketed - from €22/ton one year ago to €52/ton today (down from a peak at €56/ton in May), as illustrated on the following price chart:

Yes, the gradual increase of EU Allowance (EUA) prices is built into the system, and we just entered phase 4 of the ETS framework.

And yes (as discussed below), the European CO2 market was disrupted by the Covid crisis, with industrial activity (and the corresponding emissions) shrinking, then expanding again over a short time span.

But still, such extreme market dynamics are worth a closer look. What can machine learning tell us about past and current European CO2 price drivers?

Data categories

We are using Datapred to model weekly EUA prices since 2018, and then measure the contribution of potential price drivers to our understanding of CO2 price trends.

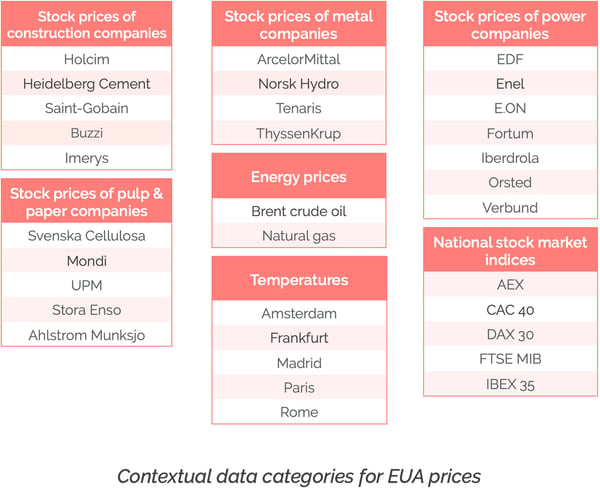

We are including the following contextual data:

Our goal is to represent/capture likely market forces, with data that is freely available on a daily basis.

- The stock prices of major European construction, pulp and paper, metal and power companies are proxies for the health and activity of big demand-side participants in the European ETS.

- Temperatures are traditionally considered a significant driver of CO2 emissions and prices, at least in the short term.

- Energy prices are there because emissions come from burning fuel or fuel equivalents.

- We use national stock market indices as proxies for macroeconomic activity (proper macroeconomic data is too scarce and polluted).

In addition to contextual data, we are also analysing EUA price movements - what we call "price momentum". The idea is that public markets have a life of their own, and we want to capture the potential impact of that buzz on prices.

Findings

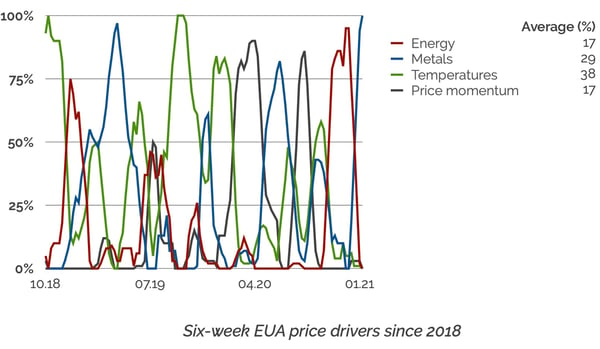

Price drivers are unstable

That is intuitive, but nice to verify: price driver importances (i.e. their contribution to our understanding of EUA price movements) change with market conditions. The following chart shows these fluctuations for six-week price drivers since 2018:

Continuously monitoring price driver importances is thus a great way for industrial buyers to stay current with market dynamics.

Confirmations and surprises

The numbers above confirm that temperatures significantly affect European CO2 prices, even at the relatively long six-week horizon (the impact of temperature is much shorter-term on natural gas and electricity prices).

European metal companies will not be surprised (though certainly frustrated) to see that EUA prices go up when they are doing well...

It is however unexpected to find that although European power companies are the largest buyers of CO2 certificates, their health and activity (as approximated by their stock prices) tells us nothing about EUA price trends. Datapred's combination of models is ignoring that contextual data category altogether.

Datapred's modeling engine is also leaving aside national stock market indices. That's unusual - our experience across raw materials and energies is that including this contextual data category is always useful (as you would expect, given how important macroeconomic conditions are for commodity markets).

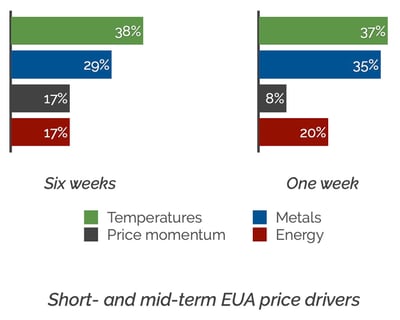

Short- and mid-term price drivers

Our analysis of CO2 price drivers suggests the European ETS is not a super fast market: the drivers of one-week and six-week price trends don't differ significantly, as illustrated below:

One practical consequence here is that industrial buyers of EUAs probably benefit from decision windows of a few weeks, not a few days.

2020 was definitely different

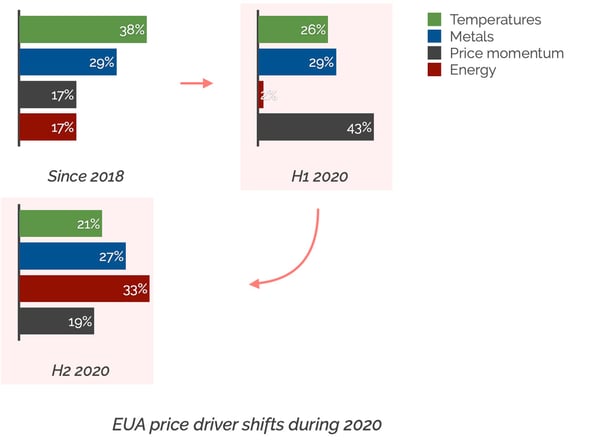

Looking at how EUA price drivers evolved during 2020 confirms that it definitely was a special year:

We can clearly see in the charts above how the Covid crisis quashed historical CO2 market forces during H1 2020. For the Datapred modeling engine, understanding price momentum suddenly became critical.

This is something we saw across raw materials and energies. It was as if machine learning was telling us: "you know what, I don't understand context anymore, so I will just focus on technical analysis".

H2 saw a gradual reversal to traditional levels of impact for temperatures, the health and activity of metal companies, and price momentum, but...

So what about 2021?

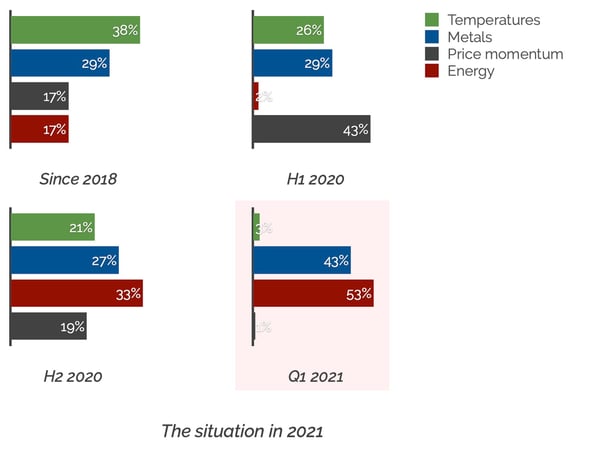

The big novelty about European CO2 price drivers in 2021 (already forming at the end of 2020) is the major impact of energy prices:

This is clearly unprecedented. Over an entire quarter:

- We have never seen such a low impact of temperature

- Pure market buzz ("price momentum") has never contributed so little to our understanding of short and mid-term EUA price trends

- The contribution of energy prices has never been so big

So to answer our opening question: energy prices (or expectations about energy prices) are currently driving CO2 prices in Europe.

Accurately factoring in energy price movements into EUA buying decisions will be key for industrial participants in the European ETS over the next few weeks.

Datapred can help - don't hesitate to contact us and discuss how. You can also check our page on energy procurement for more resources on similar topics.